Table of Contents

What is Academic Probation?

Academic probation functions as a warning signal that your academic performance falls beneath the established standards for satisfactory academic standing at your institution. Typically, colleges gauge academic progress based on factors like GPA and the accumulation of earned credits. Falling short of these benchmarks could lead to your placement on academic probation. It’s important to note that there might be a possibility of transferring schools even while on academic probation. As a general guideline, possessing a cumulative GPA of less than 2.0 renders you subject to this academic probationary status. However, even a lower term GPA (ranging from 1.5 to 1.99) might trigger this status as well.

During the span of your academic probation, you are granted the opportunity to enhance your performance and regain your academic trajectory. Failing to do so could potentially result in serious ramifications, such as dismissal from your academic program or the loss of financial aid. While on academic probation, it’s probable that you will be expected to:

- Pass a certain number of credits

- Earn an acceptable grade point average (GPA) which each college sets

- Meet with your academic advisors

Can I Transfer While on Academic Probation?

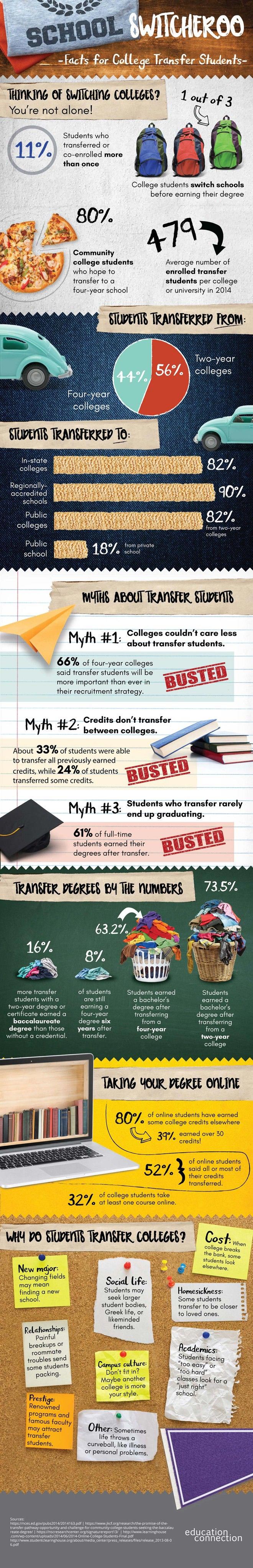

The possibility of transferring while under academic probation does exist. However, the feasibility of this option hinges on the specific evaluation criteria set by each individual college. When you embark on the process of applying for a transfer during your academic probationary period, certain applications might inquire about your current academic standing. Responding with a “no” allows you the opportunity to elucidate the circumstances surrounding your probation.

In this context, you can elucidate your individual circumstances and challenges. This approach enables you to offer a well-rounded view of yourself beyond a mere “C” grade. Within colleges that operate with open admissions policies, this narrative could suffice. Such institutions might be inclined to extend acceptance irrespective of a lower GPA. Conversely, selective colleges may adopt a different stance.

How Do Students End Up on Academic Probation?

A range of internal and external factors could lead to academic probation and academic probation transfer. Internal factors are things like anxiety over test taking. And external factors are ones you can’t control. These are a ten more common causes of academic probation.

1. Entering college with a lack of skills

Research conducted by UC Berkeley unveiled that students who engaged in numerous AP courses during high school were 3 – 5% more likely to maintain good academic standing compared to those who did not.

2. Not showing up to class

Frequent class absences can impede your GPA and overall standing. Some institutions enforce automatic fail or grade deduction protocols for excessive absenteeism.

3. Overwhelming Course Load

Students occasionally enroll in an excessive number of courses without realizing the complexities of managing the workload. The freshman year, marked by shifts in sleeping, eating, and studying routines, may further exacerbate this challenge.

4. It’s tough to time manage

Even if you enroll in a seemingly balanced credit load, if the classes necessitate extensive reading, writing, or prolonged lab sessions, it might lead to overload. Consulting with an academic advisor can facilitate the creation of a more manageable schedule.

5. Too many pass / fail grades

An excessive reliance on pass/fail grades instead of letter grades might adversely influence your academic standing.

6. Poor study habits

Many students attempt studying techniques that are ill-suited to their individual learning styles. According to UC Berkeley, 82% of students on first-year probation cited poor study habits as impediments to success.

7. Mental health and illness

An equivalent 82% of students on probation reported feelings of stress, depression, or distress. Furthermore, health problems, family crises, and other personal issues can trigger a chain reaction impacting academic performance.

8. Completing too few credits

Dropping a substantial number of courses might contribute to a GPA decline. Knowing the required credits for each term can be advantageous in preventing this scenario.

9. Too much partying

Late nights, hangovers, and heightened social activities can exert a toll on both physical well-being and academic grades. Noise-related roommate conflicts may further exacerbate this impact.

10. Lack of interest

While some classes captivate your attention, others might fail to ignite enthusiasm. Maintaining effort levels can prove challenging when your engagement is lacking, particularly in core courses or those relevant to your major.

How to Get Off Academic Probation

Often, an academic probation warning spells out your next steps. These steps may differ between schools and students but are likely to refer to GPA policies. Schools may have two GPA policies for students on academic probation. These are:

Overall GPA policy

A common GPA to meet is 2.0 on a 4.0 scale. This means that your cumulative GPA from all terms at that one college must be at least 2.0 by the end of each semester or quarter. Bringing your grades up to this level may take you off academic probation.

Term GPA policy

Term GPA s the cumulative grade received at the end of a given academic term. You may have to make progress towards this goal while also meeting the overall GPA asks. If you do, it may show the school enough effort on your part that they extend your probation period. Another thing to keep track of is a probation timeline. This varies too and some online colleges (Walden is one) won’t let you progress if you don’t pass the first course in your curriculum.

Tips to Improve Academic Performance

Once on academic probation, there are a few things that may help improve your grades.

- Get some advice. Meet with advisors and faculty and ask for guidance.

- Stop skipping class. Go to class.

- Speak up. Take part in a discussion, ask a question.

- Get a study buddy. Or join a study group to keep you accountable.

- Look for a tutor. Many colleges have tutoring centers to help you grasp key concepts.

- Block off time. Set time aside in a more official way to help you balance study with free time fun.

- Retake a course. If you can raise your GPA by retaking a course, this may be an option.

- Complete a course. Incomplete grades may equal failing grades so make sure you work with your professor to finish what you started.

How to Stay Off Academic Probation

Once you are off academic probation, celebrate your success and keep it going.

- Use a planner. There are apps or paper planners where you can keep track of due dates, exams etc.

- Tap into help networks. Colleges may have health centers, tutors, advisors and resources that you can turn to for help.

- Touch base with teachers. Many teachers keep office hours, or you may reach them by email to answer questions and concerns.

- Book routine advising sessions. Keep a handle on your schedule, issues, goals and workflow through regular advising sessions.

How Can Academic Probation Affect Financial Aid?

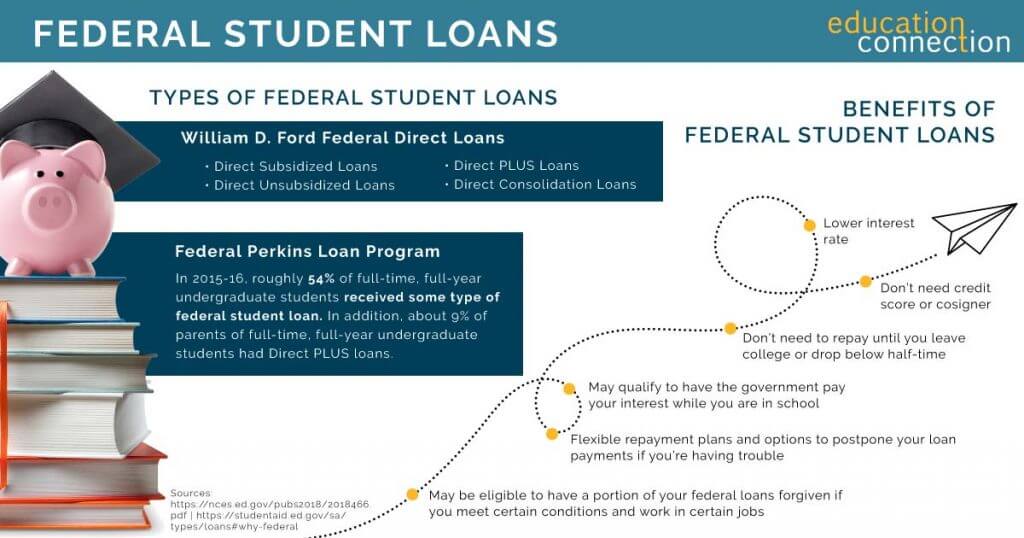

Many forms of aid including scholarships require students to be in good academic standing. Since academic probation is a warning that grades are falling, it does risk loss of financial aid. The Pell Grant is one example. It is money you typically do not repay to the federal gov’t.

Unless you fail to meet conditions. Like you withdraw early from the program for which you got the grant. Or, you change your enrollment status. Also, you cannot renew a Pell Grant id you do not make “satisfactory academic progress.” Given, each school may define progress differently.

To stay eligible or become re eligible for financial aid after academic probation you are likely to have to:

- Meet and keep up the acceptable GPA stated by your college (such as 2.0)

- Move towards graduation by taking a specified number of credits per year or term

- Avoid incomplete (“I”) grades and withdrawals

FAQs on Academic Probation

What should I do now?

Make certain you comprehend the terms stipulated in your academic standing notification and concentrate on enhancing your performance in the forthcoming quarter.

What GPA will get me into academic probation, and what GPA do I need to get out?

Attaining a GPA ranging from 1.5 to 1.99, when the minimum required is 2.0, might place you on academic probation. Consequently, depending on your current standing, you may need to elevate it to 2.0 or above. Certain institutions, such as UC Santa Cruz, provide a GPA Calculator tool on the student portal, aiding in determining the precise grades required for improvement.

Does a W affect academic probation?

The ‘W’ symbolizes withdrawal from a course, indicating no grade or credits awarded. Consequently, it might not impact your GPA. However, there might be institutional regulations regarding the maximum number of withdrawals permitted for a student.

How long does it take to get out of academic probation?

The Registrar’s Office at your college may set a specific timeframe, such as one semester or two semesters, as a stipulated period for emerging from academic probation.

What happens if my GPA doesn’t improve when I’m on academic probation?

In certain institutions, failure to enhance your GPA while on academic probation could result in suspension or even dismissal. It might also impede progress within your chosen major.

Can I take summer classes to improve my academic standing?

Generally, yes, and this could be a viable strategy. However, it’s advisable to consult your academic advisor and acquaint yourself with college policies prior to making this decision.

What is a second academic probation?

Typically, it implies that your GPA has remained below 2.0 for two consecutive semesters.

Is it possible to graduate while on Academic Probation?

The likelihood of graduating while on academic probation is exceedingly slim. For instance, institutions like the American Military University (AMU) explicitly state that this scenario is not possible.

Can You Attend Another College While on Academic Suspension?

Attending another college while on academic suspension depends on the institution’s policies. Some colleges may accept students on suspension, but admission requirements vary. It’s best to check with the school you’re interested in to understand their transfer eligibility criteria.