What Is a BBA Degree?

Get Matched for FREE to a BBA Degree!

Table of Contents

What Does BBA Stand For?

BBA stands for Bachelor of Business Administration. This degree offers a comprehensive understanding of business fundamentals, earning it the nickname “holistic management degree” due to its general nature.

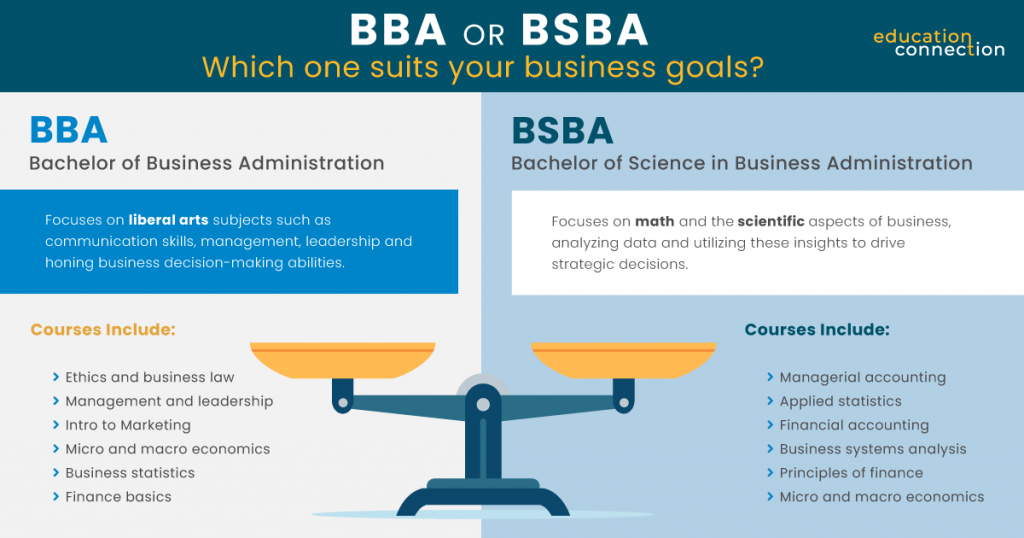

In BBA programs, the emphasis lies in cultivating communication skills and honing business decision-making abilities. Moreover, these programs provide valuable insights into the factors that contribute to a business’s success. Interestingly, BBA degrees often focus on liberal arts subjects rather than intensive calculations.

What Is the Difference Between BBA vs BSBA Degrees?

Both the BBA and BSBA degrees share a solid foundation of business courses, covering topics like marketing, economics, operations, and business law. However, the key distinction lies in the extent of math and finance coursework.

Typically, the BBA provides a well-rounded exploration of various facets of business. On the other hand, the BSBA leans towards a more math-oriented approach, immersing you in the realm of commerce.

Most BSBA programs aim to cultivate an analytical mindset. You’ll delve into a company’s cash flow statement and budget, mastering the art of deciphering data and utilizing these insights to drive strategic decisions.

Choosing between a BBA and BSBA may hinge on the specific skill sets you wish to develop, as the area of focus within your business administration degree can significantly shape your future career path.

BBA Degree Coursework

In general, a BBA program encompasses a total of 120 credits. Around one third of these credits are dedicated to general education and liberal arts courses, which include subjects like public speaking, psychology, business writing, and English.

The remaining portion of the curriculum constitutes the business core. In these classes, students gain a comprehensive understanding of how companies operate and develop an appreciation for applying these concepts in real-world business scenarios.

This often means learning to manage people, finances, and risk for companies of all sizes. While no two programs are the same, some popular BBA classes might include these topics.

- Ethics and business law

- Management and leadership

- Intro to Marketing

- Micro and macro economics

- Business statistics

- Finance basics

Along with your classes, you may have a capstone project or thesis. Most schools offer a menu of concentrations to help you tailor your studies too.

According to the BLS, According to the Bureau of Labor Statistics (BLS), employment in business and financial occupations is expected to grow at a rate faster than the average for all occupations from 2023 to 2033. Additionally, the average annual salaries in this field are expected to be $99,580, which was higher than the median annual wage for all occupations of $48,570.

How Long Does it Take to Earn a BBA?

Earning a BBA or BSBA degree typically takes four years of full-time study. However, if you have transfer credits, you may be able to expedite the process. Certain colleges also provide accelerated programs or offer a 4 + 1 option for those planning to pursue a master’s degree. In a 4 + 1 program, your bachelor’s and master’s classes can overlap, allowing you to complete both degrees in a shorter timeframe.

BSBA Degree Coursework

A BSBA program consists of 120 credits, focusing on the scientific aspects of business. Compared to a BBA, the BSBA narrows its scope to delve deeper into specific topics.

This specialization may involve additional courses in accounting, banking, and finance, as well as subjects like calculus and business analytics. Some schools may also include technology-focused courses in their curriculum.

The emphasis on these classes is to equip you with the ability to convert business intelligence into practical strategies. Ultimately, you will apply and integrate these skills into a final management capstone project.

While no two BSBA programs are the same, these classes are popular.

- Managerial accounting

- Applied statistics

- Financial accounting

- Business systems analysis

- Principles of finance

- Micro and macro economics

What Can You Do with a BBA or BSBA Degree?

With a BBA degree, you can develop essential skills in sales, marketing, and administration. Throughout the program, you’ll learn to create business plans, maintain accurate financial records, handle personnel matters, and navigate legal issues.

These abilities can be beneficial if you aspire to start your own business or pursue entry-level positions such as accountant, loan officer, sales manager, or roles in human resources.

On the other hand, a BSBA degree program hones various foundational skills, including accounting, finance, economics, management, marketing, and international business. This broad knowledge base opens up a wide range of career possibilities in the business world.

You may also gain other useful abilities like leadership and analysis. This may enable you to pursue entry level positions as:

Financial Aid Info

- Your Guide to Federal Student Loans

- Grants and Scholarships

- Military Benefits

- Private Student Loans

- Repaying Student Loans

- Student Loan Consolidation

- Education Tax Credits | AOTC & LLC

- 15 Military Scholarships to Apply For in 2023

- Grad School Scholarships

- 12 Graduate Scholarships for DACA Students in 2025

- Graduate Scholarships for International Students

- Grants for Women

- Guide Schools & Scholarships for Students with Disabilities

- Guide Tribal Colleges and Scholarships for Native Americans

- 8 Adult Scholarships for Adults Returning to School

- How to Earn Credit for College with Life Experience

- The Psychology of Lying

- 36 Companies That Pay For College

- FAFSA: Parent and Student Assets

- How Do You Get Student Loans Without a Job?